WASHINGTON — HawkEye 360, a U.S. commercial satellite company that tracks radio-frequency signals from orbit, announced Dec. 18 it has acquired defense contractor Innovative Signal Analysis, deepening its push into military and intelligence markets.

Financial terms of the acquisition were not disclosed. HawkEye 360 said the deal was supported by a Series E equity and debt financing round totaling $150 million.

Innovative Signal Analysis, or ISA, is based in Dallas and specializes in electronic signal and image processing systems for U.S. government customers. The company will operate as a subsidiary of Virginia-based HawkEye 360.

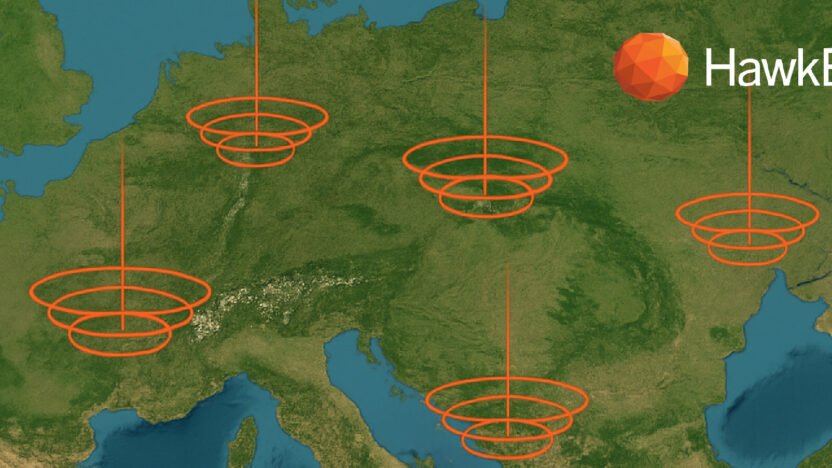

HawkEye 360 sells radio-frequency, or RF, geolocation data primarily to the U.S. military, intelligence agencies and allied governments. Its data are used for maritime domain awareness, monitoring spectrum use, identifying radar systems and supporting intelligence, surveillance and reconnaissance missions without relying on optical imagery or active sensors.

Chief Executive John Serafini said the acquisition strengthens HawkEye 360’s position in defense and intelligence by combining space-based RF collection with advanced processing across multiple domains.

“By combining multi-domain collection with advanced processing expertise, the merged organization will strengthen automation, expand detection across more signal types, and support a broader range of mission needs for defense, government and international partners,” Serafini said.

ISA brings algorithms, edge and cloud-based processing solutions, and engineering expertise that can handle large volumes of RF data from space, aerial and ground-based sensors, Serafini said.

The deal also gives HawkEye 360 an entry point into classified programs, which factored into the acquisition decision, he said.

“We’re a defense technology company that specializes in signals intelligence,” Serafini said. “We’ve raised nearly half a billion dollars to solve critical defense problems.”

Series E financing

Founded in 1997, ISA is headquartered in Texas with a secondary office in Colorado. The company has several contracts with the Department of the Air Force focused on exploitation of electronic intelligence. It also produces a wide-area surveillance camera designed to automatically track moving objects and flag anomalies.

ISA president Stacy Kniffen said the acquisition brings together complementary technical teams.

“We’re very excited to be joining forces with HawkEye 360. The combined organization provides a highly talented, mission-focused technical team,” Kniffen said in a statement.

HawkEye 360 operates a commercial low Earth orbit constellation designed to detect, geolocate and characterize RF emissions, then package those data into analytics products that government users can integrate into operations. Founded in 2015, the company was an early entrant in selling commercial signals intelligence from space as a service. Serafini said HawkEye 360 has launched about 30 satellites to date.

“We have to continue to innovate and build better sensors on orbit,” he said.

The Series E preferred equity round was co-led by existing investors Night Dragon and Center15 Capital. Additional secured and mezzanine debt financing was provided by Silicon Valley Bank, Pinegrove Venture Capital Partners and Hercules Capital.

HawkEye 360 has increasingly focused on U.S. and allied defense work as commercial RF intelligence has matured, Serafini said, pointing to operational use in conflicts such as Ukraine.

Earlier this month, the National Reconnaissance Office extended the company’s existing contract for RF signals intelligence and data services by 23 months. The U.S. Navy also renewed its contract with HawkEye 360 for a fourth consecutive year under the Indo-Pacific Partnership for Maritime Domain Awareness initiative. That extension is valued at $98.8 million and provides access to RF data and analytics for vessel monitoring across the Pacific.

On Dec. 10, HawkEye 360 announced a five-year contract worth more than $100 million with an undisclosed international partner for access to its RF data and analytics.